International Regulatory Engagement

International regulatory compliance requirements vary greatly from country to country: a one-size-fits-all approach to cloud and technology risk and compliance is unwise.

At Capital Consult, we assist banks, insurance companies and other FSIs to comply with the wide range of regulations set by international regulators such as the Monetary Authority of Singapore (MAS), Hong Kong Monetary Authority (HKMA) and others.

- We have Cloud, Data and Technology Outsourcing expertise across many international jurisdictions

- We can plan and run multi-jurisdictional cloud initiatives, constructing a global migration narrative and compliance approach

- We build a global view of the regulatory landscape for technology risks and compliance, streamline multi-country engagement and work closely with local country technology, risk and compliance teams to achieve in-country and local Regulator approvals in each target jurisdiction.

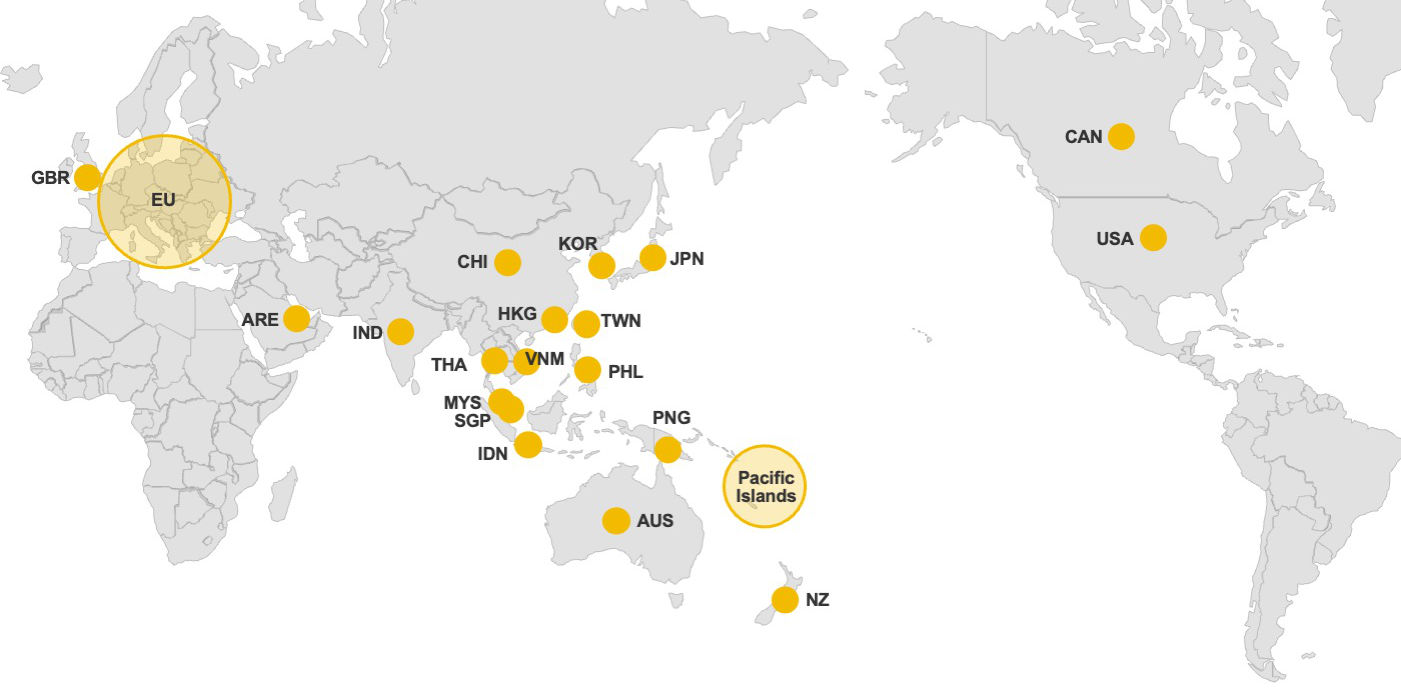

Countries we've worked with

Our International Regulatory Engagement Services

Some ways we help FSIs with their Outsource and Cloud APRA engagement

Assessment and Roadmap

Interpret APRA, MAS, HKMA or other international regulator scope and requirements for the review. Define, source and assure all supporting evidence.

Determine gaps in operating maturity to APRA and other international standards and ensure these are understood and managed.

Remediation Support

As a result of risk reviews or engagements, there may be a series of actions and recommendations imposed by the regulator or required to uplift a project to regulatory requirements.

This remediation activity may require a stand-alone project to deliver to the regulator’s time expectations. We offer management and consulting expertise to work with BAU and projects teams on remediation activity and to engage with your local in-country compliance, technology and risk teams

Regulatory Consultation Advisory

- Regulator notification and engagement preparation and authoring services

- Prepare presentations for the APRA/international regulator on site interviews. Coaching and preparation of presenters. Manage timelines and outputs for all deliverables

- Work closely with In-Country teams for local regulator preparation and engagement

Case Study

The Situation

An international bank with commercial operations in over 20 countries created an initiative to migrate a portion of their global application suite to the cloud.

These applications ranged from test/preproduction systems through to applications Material to Australia, Hong Kong, Singapore and other country operations.

The challenge our client faced was they needed to understand the complex and diverse regulatory and governance requirements within the bank and to country regulators. The pathway to approvals needed to be designed and streamlined.

What We Did

Capital Consult were engaged to design and deploy the bank's manual for Cloud; mapping key enabler teams to engage, governance and compliance points and regulatory engagement. This manual covered all aspects of cloud delivery and readiness for country teams and Regulators.

Our team managed all aspects of regulatory compliance for cloud and outsourcing across all 32 countries, engaging with in-country Compliance, Technology, Risk and leadership forums.

The Outcome

New country engagement operational processes were embedded in the business. The manual we developed enabled all project and business teams to navigate the complex requirements and pathway to international regulatory compliance.

The patternised approach to delivery was accepted and future workloads were enabled to migrate to cloud at scale.